reverse sales tax calculator florida

Enter your before tax purchase price followed by the sales tax rate in your area. Enter the final price or amount.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Calculator formula Here is how the total is calculated before sales tax.

. Before Tax Price Sales Tax. This reverse sales tax calculator will calculate your pre-tax price or amount for you. Here is the Sales Tax amount calculation formula.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts. This sales tax calculator is simple. This is the after-tax.

Reverse sales tax calculator florida Sunday April 3 2022 Edit. See the article. True tax Calculator 2005 is an Income tax calculator for the Assessment Year 2005-06 specially designed for Indian Income-Tax payers Individuals.

You will need to input the following. Enter the total amount that you wish to have calculated in order to determine tax on the sale. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

Reverse Sales Tax Formula. Just fill the details of your. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Before-tax price sale tax rate and final or after-tax price. Next a sales tax is calculated as well as a total purchase price including. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to.

Reverse Sales Tax Calculator De Calculator. Sales tax calculator to reverse calculate the sales tax paid and the price paid before taxes. Floridas general state sales tax rate is 6 with the following exceptions.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Tax rate for all canadian. The Sales Tax Calculator over here finds out the Tax imposed on various goods and services easily and makes your calculations quick and simple.

Cryptocurrency Taxes What To Know For 2021 Money. Before tax price in case of Reverse. Divide the tax rate by 100.

75 sales tax in Duval County 21200 for a 20000 purchase Inverness FL 6 sales tax in Citrus County You can use our Florida sales tax calculator to determine the applicable sales. Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if. Your household income location filing status and number of personal.

Enter the sales tax percentage. Divide the final amount by the value above to find the original amount before the tax was added. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

For instance in Palm Springs California the total. A tax of 75 percent was added to the product to make it equal to 35473925. Current HST GST and PST rates table of 2022.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Charge Your Customers The Correct Sales Tax Rates

How To Calculate Sales Tax Backwards From Total

Sales Tax Guide For Online Courses

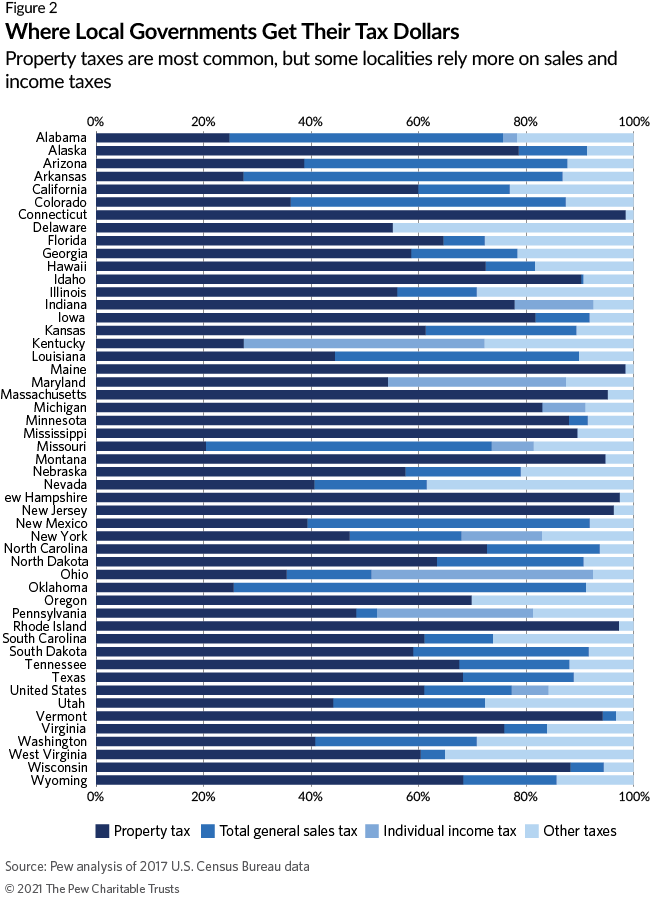

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

1 125 Sales Tax Calculator Template

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

:max_bytes(150000):strip_icc()/dotdash-reverse-mortgage-or-home-equity-loan-v3-eb9ddc756b1d47adba885c60bf2f854c.jpg)

Reverse Mortgage Vs Home Equity Loan Vs Heloc What S The Difference

How To Add Sales Tax 7 Steps With Pictures Wikihow

What You Need To Know About Car Valuation And Insurance Forbes Advisor

Stripe Tax Automate Tax Collection On Your Stripe Transactions

Reverse Sales Tax Calculator 100 Free Calculators Io

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Florida Vehicle Sales Tax Fees Calculator