december child tax credit date 2021

Find out if they are eligible to receive the Child Tax Credit. Child Tax Credit dates.

Child Tax Credit Payment Schedule For 2021 Kiplinger

757 AM CST November 17 2022.

. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Get the Child Tax Credit. October 5 2022 Havent received your payment.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. The final child tax credit is set to hit bank accounts in December. Wait 10 working days from the payment date to contact us.

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Some families received part of their 2021 Child Tax Credit through monthly payments from July to December 2021. This means that the total advance payment amount will be made in one December payment.

17 is an important deadline for millions of Americans who may still need to claim stimulus checks and. 15 at 1159 pm. More from Personal Finance.

Claim the full Child Tax Credit on the 2021 tax return. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. Children draw on top of a Treasury check prop during a rally in front of the US.

The credits scope has been expanded. Last day for December payments. To receive the rest you need to file a tax return.

All payment dates. Child Tax Credit dates. Understand that the credit does not affect their federal.

Enhanced child tax credit. Previously only children 16 and younger qualified. The IRS and US.

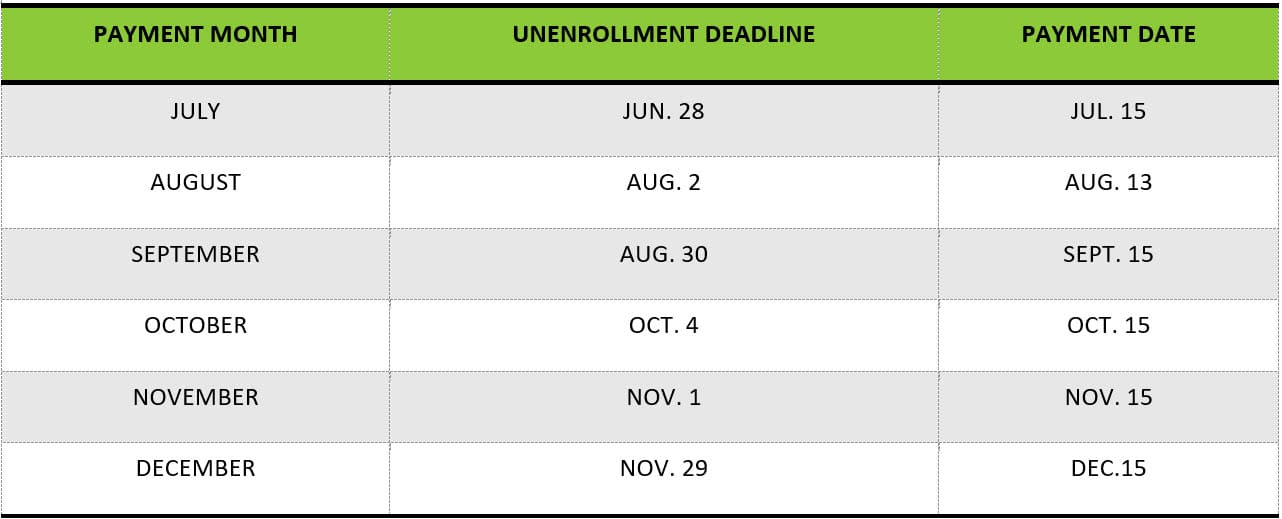

Understand how the 2021 Child Tax Credit works. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

To be a qualifying child for. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Eligible families who did not.

The credit amounts will increase for. 1200 sent in April 2020 Second. But you have to act fast.

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly. However the deadline to apply for the child tax credit payment passed on. Department of the Treasury are ending out the.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Update Next Payment Coming On November 15 Marca

.jpg)

Divorced Parents Actcp Leavitt Law Firm

Policy Brief The Child Tax Credit Ctc Committee For Economic Development Of The Conference Board

What Families Need To Know About The Ctc In 2022 Clasp

Missing A Child Tax Credit Payment Here S How To Track It Cnet

4 News Now Q A What Should Parents Know About The New Child Tax Credit Kxly

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Child Tax Credit Advanced Payments Information Bc T

Some Families Missing Out On Child Tax Credit

Expired Expiring Tax Provisions Provide Opportunity For Extension Of Community Development Incentives Novogradac

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Deadline To Claim Automatic Payment Between 1 400 And 3 600 Is Just Days Away See Exact Date And If You Re Eligible The Us Sun

Child Tax Credit Monthly Advance Payments To Start Arriving July 15

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty